Investment Platform Comparison: An Allocator's Guide to Vetting Crypto Opportunities

Explore our investment platform comparison guide to find the best options for BTC and stablecoin strategies. Make informed investment decisions today!

Oct 16, 2025

generated

investment platform comparison, crypto investment, BTC strategies, stablecoin yield, Fensory

Choosing the right investment platform is the foundation of any sophisticated crypto strategy. The platform dictates the quality of data, the accessibility of strategies, and the clarity of market insights. The primary distinction lies between institutional-grade platforms, offering surgical analytical tools and direct manager access, and more common retail aggregators, which provide a simplified, broad-market view without the necessary depth for professional due diligence. The choice ultimately depends on a single question: do you require deep, granular control, or is a straightforward, simplified interface sufficient for your needs?

Navigating the Modern Crypto Investment Landscape

For any serious allocator, the decision of where to invest in BTC and stablecoins has evolved significantly. The market has matured beyond a simple choice between a basic exchange and a traditional financial institution cautiously entering the crypto space.

Today’s allocators—whether high-net-worth individuals, family offices, or institutional fund managers—require more than just transactional capabilities. They need a comprehensive ecosystem for discovering opportunities, conducting rigorous analysis, and executing sophisticated strategies seamlessly. This guide provides a detailed investment platform comparison, breaking down the key differences between platforms engineered for professional capital and those designed for a retail audience.

The Evolving Demands of Crypto Allocators

As institutional capital continues to enter the digital asset market, the investment landscape is rapidly maturing. Projections indicate the global online investment platform market will grow from USD 1.88 billion in 2021 to an estimated USD 5.90 billion by 2030, signaling sustained institutional interest. For more details on this market expansion, see the report on grandviewresearch.com.

This growth introduces new layers of complexity. Allocators must now evaluate platforms based on criteria that extend far beyond surface-level features. Utilizing tools like DeBank for DeFi portfolio tracking can offer a clearer perspective on asset performance across different protocols. The critical question has shifted from "what can it do?" to "how well does it support genuinely informed decisions?"

The core challenge for today's crypto allocator is filtering signal from noise. A superior platform doesn't just present opportunities; it provides the institutional-grade data and direct access needed to properly vet them.

This comparison will move beyond marketing claims to focus on the elements that truly impact risk management and long-term performance.

Key Differentiators at a Glance

Before delving into a detailed analysis, here is a high-level overview of what separates professional-grade platforms from their retail-focused counterparts.

Feature | Institutional-Grade Platform (e.g., Fensory) | Retail-Focused Aggregator |

|---|---|---|

Primary Goal | Deep due diligence and direct strategy access. | Simplified user experience and broad access. |

Data Analytics | Granular, real-time performance and risk metrics. | Basic charting and historical price data. |

Product Discovery | Curated, vetted strategies with deep insights. | Wide, unvetted selection of assets and pools. |

Connectivity | Direct access to fund managers and strategists. | Intermediated access, often through APIs. |

Core Pillars for Evaluating Investment Platforms

To effectively compare platforms, we need a robust evaluation framework. For professional allocators, selecting the right platform goes beyond low fees or an extensive asset list. The real value lies in the quality of analytical tools and direct market access.

This framework is built on four core pillars that distinguish an institutional-grade platform from a basic retail application. These pillars form the foundation of a thorough due diligence process, ensuring the chosen platform can support sophisticated BTC and stablecoin strategies with the required precision and clarity.

Pillar 1: Product Discovery and Curation

The first pillar is Product Discovery and Curation. An unfiltered, expansive list of investment options is not a feature; it is a liability. For a professional investor, the primary challenge is not finding opportunities but filtering through noise to identify high-quality, vetted strategies that align with a specific risk mandate.

A top-tier platform acts as a curator, offering a carefully selected range of strategies—from structured notes to Separately Managed Accounts (SMAs)—that have passed an initial screening. This process saves allocators significant time and raises the quality standard for potential investments. The focus shifts from sifting through low-quality options to analyzing a concentrated set of credible, relevant opportunities.

Pillar 2: Data Analytics and Benchmarking

Next, Data Analytics and Benchmarking are non-negotiable for proper due diligence. Allocation decisions cannot be based on a simple return figure. A comprehensive understanding of risk-versus-reward requires deep, granular data.

This means direct access to:

Historical Performance Metrics: How has a strategy performed against relevant BTC or stablecoin benchmarks?

Risk-Adjusted Returns: Key ratios like Sharpe and Sortino are essential for understanding the volatility associated with returns.

Maximum Drawdown Analysis: What were the worst performance periods for this strategy?

On-Chain Data Verification: The ability to independently verify a strategy's on-chain activity provides a critical layer of transparency.

A platform's true analytical muscle is shown by how well it turns raw data into actionable insights. Without strong benchmarking tools, you're flying blind, unable to place performance in context or make fair comparisons between managers and products.

Pillar 3: Direct Connectivity and Execution

The third pillar, Direct Connectivity and Execution, addresses a significant challenge in the digital asset space. Many platforms act as intermediaries, creating a layer between the allocator and the strategy manager. This model can lead to communication gaps, misunderstandings, and hidden costs.

Direct connectivity removes these barriers, enabling allocators to communicate directly with fund managers or product issuers on the platform. This streamlines the due diligence process, accelerates decision-making, and fosters a more transparent relationship. Efficient capital deployment depends on this direct line of communication, avoiding friction and costly delays.

Pillar 4: Transparency and Reporting

Finally, Transparency and Reporting is the foundation upon which trust is built. This extends beyond a visually appealing performance dashboard to include clear, comprehensive insight into every aspect of an investment. For a professional allocator, understanding the total cost—including management fees, performance fees, and potential slippage—is essential for calculating true net returns. To see how reporting capabilities differ, you can explore the various models of crypto asset management software.

A superior platform provides clean, auditable reports on demand. This ensures a clear, unambiguous view of your portfolio's performance, risk exposure, and all associated costs. Without this level of transparency, genuine risk management is impossible. These four pillars provide the framework for a meaningful platform comparison.

Comparing Leading Crypto Investment Platforms

With the four pillars established—discovery, analytics, connectivity, and transparency—we can conduct a practical investment platform comparison. A thoughtful analysis reveals how a platform's core design either supports or hinders an allocator's ability to execute a professional investment strategy.

To illustrate these differences, we will compare Fensory against two common platform types: the 'Retail-Focused Aggregator' and the 'Traditional Prime Broker' entering the digital asset space. This side-by-side analysis will highlight the critical trade-offs allocators face when selecting a platform for their BTC and stablecoin investments.

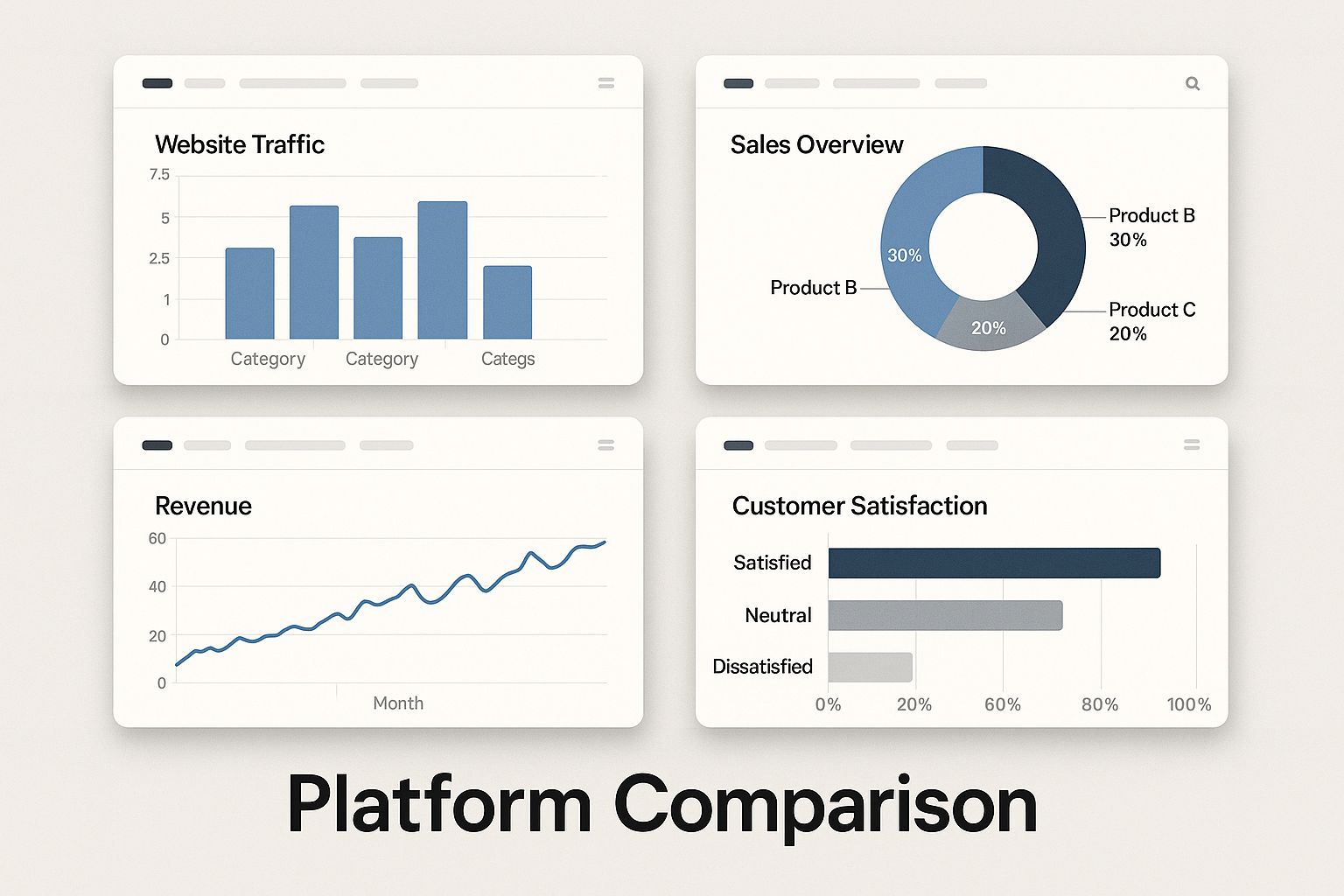

This comparison helps visualize how different dashboards and user interfaces present information, which directly impacts an allocator’s decision-making.

The visual contrast between a simplified retail view and an institutional-grade data terminal underscores the importance of choosing a tool that matches the depth of your analytical needs.

Product Discovery And Curation

The first major differentiator is how each platform manages the universe of available products. This initial philosophy shapes the entire user experience.

A Retail-Focused Aggregator typically prioritizes breadth over depth, offering a massive, often unfiltered, menu of assets and yield pools. While this may appear advantageous to a novice, it creates a significant due diligence burden for a professional allocator. The platform functions like a supermarket with thousands of items, leaving all quality control to the user.

Conversely, a Traditional Prime Broker moving into crypto usually offers an extremely narrow and conservative selection. Their product list is often limited to large, well-known funds or basic BTC spot exposure, reflecting a cautious institutional mindset. This approach is safe but often overlooks the innovative and diverse yield strategies emerging in the BTC and stablecoin ecosystem.

Fensory adopts a strategic middle path, focusing on curated discovery. Instead of an overwhelming number of options, the platform presents a handpicked selection of strategies—from SMAs to structured notes—that have met specific standards for transparency and operational integrity. This curated approach saves allocators time and ensures the discovery process begins with a baseline of quality.

An allocator's most valuable asset is time. A platform that forces you to sift through hundreds of low-quality or irrelevant strategies is creating friction, not value. Curated discovery is the first filter in a professional due diligence process.

This difference is critical in practice. For instance, an aggregator might list 50 different stablecoin yield pools with little context on their underlying risks. Fensory, in contrast, might feature 10 vetted stablecoin strategies, each accompanied by detailed documentation on risk parameters and performance history. To better understand the landscape, explore some of the best alternative investment platforms and compare their discovery models.

Data Analytics And Benchmarking

The analytical capabilities of a platform are where the differences become most pronounced. This is the core engine for any serious investment decision.

Retail-Focused Aggregators almost always provide simplified analytics. Their tools are designed for a mass audience and typically include:

Basic price charts with common indicators like moving averages.

Annual Percentage Yield (APY) displayed prominently without context.

Limited historical data, often omitting performance during market downturns.

While this data is accessible, it is inadequate for professional risk assessment. It conceals more than it reveals, making it impossible to calculate risk-adjusted returns or accurately assess a strategy's volatility. Learning how to trade effectively on platforms like Coinbase provides a good example of this retail-first approach to user experience and data presentation.

Traditional Prime Brokers may offer more robust reporting, but it is often presented in a static, legacy format. You might receive a monthly or quarterly PDF report, but real-time, interactive analytics are typically unavailable. Their systems, built for traditional assets, often struggle to integrate the dynamic, on-chain data essential for crypto analysis.

Fensory, however, was built from the ground up for data-driven due diligence. It provides allocators with the tools needed to analyze a strategy from every angle, including:

Performance against custom benchmarks (e.g., BTC price, ETH price, or stablecoin yield indices).

Risk metrics such as the Sharpe Ratio, Sortino Ratio, and maximum drawdown, calculated over user-defined periods.

Transparency into underlying activity, including on-chain transaction data for DeFi vaults where applicable.

This institutional-grade toolkit enables a family office or fund to move beyond a simple APY and model how a specific strategy would perform within their broader portfolio.

Direct Connectivity And Execution

The method of interaction with product issuers is another fundamental differentiator. The level of intermediation directly impacts transparency, efficiency, and cost.

Retail platforms operate on a fully intermediated model. Users interact with the platform's interface, which connects to various pools or products via APIs behind the scenes. There is zero direct contact with the managers or teams running the strategies. This "black box" approach is unsuitable for significant allocations due to its opacity and risk.

The Traditional Prime Broker model also involves an intermediary, typically a relationship manager. While this provides a human point of contact, it is not direct access. Information is filtered, and the process can be slow and bureaucratic, adding friction to due diligence and execution.

Fensory is built on the principle of direct connectivity. The platform is designed as a bridge, not a gatekeeper, facilitating direct communication and engagement between allocators and product issuers. This enables deeper due diligence, faster decision-making, and a more transparent relationship. An allocator can ask a fund manager nuanced, critical questions without an intermediary, building trust and ensuring complete clarity.

Transparency And Reporting

Finally, the approach to transparency and reporting integrates all other pillars. This determines whether an allocator can effectively monitor investments and accurately gauge net performance.

Retail aggregators often have unclear fee structures. The advertised APY may not account for platform fees, withdrawal fees, or performance fees, which are often concealed in the fine print. Reporting is typically limited to a simple dashboard showing the current value of an investment.

Traditional prime brokers provide more formal reporting but tend to bundle costs. Fees for custody, execution, and advisory services are often combined, making it difficult to ascertain the true cost of a single investment.

Fensory operates on a principle of radical transparency. Fees are clearly itemized, and the platform's reporting tools are designed to provide a complete picture of performance, net of all costs. The goal is to furnish allocators with an unambiguous, auditable record of their investments—an essential component of proper portfolio management and stakeholder reporting. This unbundled, clear approach ensures that true net returns can be calculated with confidence.

Platform Capabilities Matrix for BTC & Stablecoin Allocators

For those managing significant capital, the chosen platform is a critical component of the investment infrastructure. The table below illustrates how these different platform philosophies translate into tangible capabilities, serving as a quick-reference guide for sophisticated allocators.

Evaluation Pillar | Fensory | Retail-Focused Aggregator | Traditional Prime Broker |

|---|---|---|---|

Product Discovery | Curated, vetted strategies (SMAs, notes) based on quality. | Vast, unfiltered list of assets and yield pools. High noise. | Limited, highly conservative selection (e.g., large-cap spot). |

Data & Analytics | Institutional-grade: risk metrics, custom benchmarks, on-chain data. | Surface-level: basic charts, misleading APY, limited history. | Legacy reporting: static PDF reports, lacks real-time data. |

Connectivity | Direct access to product issuers for deep due diligence. | Fully intermediated via platform API. Zero direct contact. | Intermediated through a relationship manager. Slow and filtered. |

Transparency & Fees | Radically transparent. Unbundled fees for clear net performance. | Opaque. Hidden fees often obscure true net returns. | Bundled costs (custody, advisory) make specific costs unclear. |

As the matrix demonstrates, the choice is not merely about features but about strategic fit. For allocators requiring deep analytical tools, direct access, and absolute transparency to manage risk and report to stakeholders, a purpose-built platform like Fensory offers a distinct advantage over models designed for mass-market retail or legacy financial systems.

Putting Theory Into Practice: How Different Investors Use Each Platform

A feature list provides only part of the story. The true test of a platform is its real-world performance for specific investors executing defined strategies. Let's examine how the architectural differences between Fensory, retail aggregators, and traditional brokers impact practical outcomes.

These scenarios reflect the day-to-day decisions faced by professional capital allocators, illustrating how access to the right data, curated products, and direct manager communication can be decisive.

The Family Office: Deep Due Diligence on a New Strategy

Scenario: A multi-generational family office intends to allocate $5 million to a new BTC-denominated credit strategy. Their mandate requires deep due diligence, focusing on risk-adjusted returns and the manager's track record, particularly through volatile market cycles.

On a Retail-Focused Aggregator, this task is impossible. The platform might list some BTC yield products, but the information is superficial. The analyst sees a prominent APY but cannot analyze the strategy's historical drawdown, its performance against a simple BTC HODL benchmark, or its Sharpe ratio. Crucially, there is no way to contact the manager to ask critical questions about risk management.

A Traditional Prime Broker offers a more formal but slow and indirect process. The family office communicates through a relationship manager, who acts as an intermediary. They might receive a pitch deck and a quarterly report but cannot access the raw, interactive data needed to run their own models. The process is sluggish, and the static data is insufficient for a forward-looking risk assessment.

With Fensory, the analyst has a toolkit designed for this exact purpose. They can immediately filter for BTC credit strategies that meet their AUM and track record criteria. From there, they can access an interactive dashboard showing:

Live and historical performance data, easily benchmarked against the price of BTC or a relevant index.

Key risk metrics like maximum drawdown and the Sortino ratio, calculable over custom timeframes.

A direct connection to the fund manager to schedule a call for an operational due diligence session.

This direct path to granular data and the manager allows the family office to build a comprehensive risk model and make a confident allocation decision in days, not weeks.

The High-Net-Worth Individual: Building a Diversified Yield Portfolio

Scenario: A high-net-worth individual (HNWI) with a large stablecoin position seeks to generate a blended yield of 6-8%. Their primary objective is diversification to avoid concentrating risk in a single protocol or counterparty.

A Retail-Focused Aggregator presents a dizzying array of options, often promoting the highest, most unrealistic APYs without context. It is easy to be enticed by pools showing 15%+ APY, but there is no simple way to vet the underlying smart contract risk, the stability of the yield source, or the counterparty’s history. This is how investors inadvertently concentrate risk in unaudited or experimental protocols.

An investment platform’s job isn't just to provide access; it's to provide clarity. Curated discovery combined with deep analytics filters out the noise and highlights the risks that a simple APY figure hides.

Using Fensory, the HNWI can build their portfolio methodically. The discovery tools present a curated menu of stablecoin yield strategies, such as:

Over-collateralized lending pools from reputable institutions.

Delta-neutral basis trading strategies run by experienced teams.

Low-leverage DeFi vaults with robust audit histories.

For each option, the platform provides transparent data on performance, fees, and risk. The investor can then construct a diversified portfolio of three to five strategies, balancing risk to achieve their target yield with a full understanding of their holdings. This represents a shift from chasing high numbers to building a resilient, risk-managed income stream.

The Crypto-Native Fund: Needing Fast, Efficient Market Access

Scenario: A nimble crypto-native fund needs to deploy capital into unique or capacity-constrained strategies where speed is critical. When an opportunity arises, they must move quickly and gain direct access to product issuers to understand the nuances before committing capital.

While digital investment platforms have expanded market access, not all are built for the precision and speed required by such a fund. Although the industry has grown by lowering barriers to entry, as shown by Statista's data on the global growth of digital investment, institutional needs are distinct.

A Retail Aggregator is a non-starter. Its intermediated model is too slow, and it does not list the niche, institutional-grade strategies the fund seeks. A Traditional Prime Broker is equally unsuitable, encumbering the fund with bureaucracy and a lack of crypto-native expertise.

On Fensory, the fund’s team operates on a platform designed for direct, efficient access. They can monitor a real-time feed of curated opportunities. When a new structured note or capacity-constrained SMA becomes available, they instantly have all relevant data and can connect directly with the issuer. This allows them to conduct rapid due diligence and secure an allocation before the opportunity disappears, providing a significant edge in a fast-moving market.

Analyzing Platform Transparency and Total Costs

In any investment platform comparison, advertised fees represent only a fraction of the total cost. Experienced allocators understand that true performance is measured by net returns, which requires a comprehensive analysis of the total cost of ownership. This means looking beyond headline management fees to uncover hidden costs that can erode performance.

Many platforms, particularly those targeting a retail audience, obscure the true cost of investing. Hidden expenses such as execution slippage, withdrawal fees, and complex performance-based charges accumulate, creating a significant gap between gross and net returns and making genuine apples-to-apples comparisons nearly impossible.

Unpacking the True Cost of Execution

The method of investment execution has a direct and significant impact on the bottom line. Aggregator platforms that act as intermediaries introduce additional layers, each contributing economic friction. When capital must pass through multiple stages before being deployed, small costs and inefficiencies are inevitably introduced.

This indirect execution model can lead to several issues:

Slippage: The crypto markets are fast-paced. Even a minor delay caused by an intermediary can result in a price difference between expectation and execution. This difference, or slippage, directly reduces returns.

Wider Spreads: Intermediaries often present less competitive bid-ask spreads, allowing them to capture a small margin on each transaction. While seemingly small, these costs accumulate over time.

Operational Delays: A cumbersome, multi-step process means capital remains idle for longer instead of being deployed to generate returns.

A direct-access model eliminates these costly middlemen. By connecting allocators directly to product issuers, platforms like Fensory facilitate more efficient and transparent execution. This simple concept ensures that more of your capital is put to work on your terms—a crucial detail often missed in a surface-level investment platform comparison.

Understanding the total cost of execution isn't just a minor detail—it's fundamental to risk management and performance analysis. You can't confidently project net returns without knowing exactly how your capital is deployed and what frictional costs are being charged along the way.

Transparency in Fees and Reporting

Beyond execution, fee structures are a key differentiator. Traditional prime brokers often use a bundled pricing model, combining costs for custody, advice, and execution into a single fee. While this appears simple, it makes it difficult to determine what you are actually paying for. Exploring different digital asset custody solutions can provide a better sense of the nuances of asset protection.

Fensory adopts the opposite approach with unbundled, transparent fee structures. Every cost associated with an investment, from the manager’s performance fee to any platform charge, is clearly itemized. This clarity provides allocators with the raw data needed to calculate their true net returns with absolute precision.

This demand for clear financial outcomes reflects a growing trend across private markets. According to a recent global private markets report, for the first time since 2015, distributions to limited partners (LPs) outpaced capital contributions, reaching the third-highest level ever recorded. The report also found that LPs now consider distributions to paid-in capital (DPI) a key performance metric that is 2.5 times more important than it was just three years ago. This shift underscores why allocators must insist on total cost transparency—it is the only way to accurately measure the metrics that truly matter.

So, How Do You Choose the Right Crypto Investment Platform?

Selecting the right platform is not about finding a universal solution. It is about aligning the platform's capabilities with your specific investment strategy, risk tolerance, and operational needs.

It is essential to look beyond marketing claims and evaluate the underlying infrastructure. For professional investors like family offices or institutional funds, the decision hinges on a few critical components: the depth of the data, the quality of the curated opportunities, and the directness of market access. These are not just desirable features; they are essential for conducting proper due diligence and managing risk at scale.

Matching the Tool to the Trade

This is where a platform like Fensory distinguishes itself for professional allocators. It was designed from the ground up with a focus on detailed analytics, vetted strategies, and direct market connectivity. This setup is necessary for confidently deploying significant capital, as it provides the transparency and analytical depth that professional investing demands.

Your investment platform should feel like a partner that sharpens your decisions, not a black box that just gets in the way. You need absolute clarity on the risks, the costs, and the real performance.

Conversely, for those just beginning to explore BTC or stablecoins, a simpler retail platform may suffice. They offer ease of use and broad access, even if they lack data depth.

Ultimately, this investment platform comparison leads to a single conclusion: choose the platform that best supports your strategy. Whether you require a high-performance analytics terminal or a simple on-ramp, the most intelligent investment is selecting the right tool for the job.

Frequently Asked Questions

When comparing platforms for BTC and stablecoin products, several common questions arise. Addressing these can help clarify what truly matters for your strategy.

Obtaining clear answers is key to moving beyond a simple feature list and finding a platform that genuinely supports your due diligence process.

How Does Direct Connectivity Actually Affect My Returns?

Direct connectivity, a core principle of platforms like Fensory, can directly impact your net returns by eliminating intermediaries.

Consider the hidden costs inherent in traditional models:

Execution Slippage: Minor delays in transaction processing can lead to less favorable prices, particularly in volatile markets.

Intermediary Fees: Markups and service charges from third parties are not always clearly disclosed.

By connecting directly with product issuers, you bypass many of these layers. Execution becomes cleaner and more efficient, ultimately allowing more of your capital to remain invested and working for you.

What Due Diligence Metrics Should I Really Be Looking At?

For any serious evaluation of a BTC or stablecoin strategy, it is essential to look beyond the advertised APY. That figure is merely a starting point.

The most critical data points are those that place performance in the context of risk. Without this, allocators cannot make truly informed decisions about how a strategy fits their portfolio.

The real insights are in the details. You need to analyze historical performance against relevant benchmarks (such as the price of BTC). Look for risk-adjusted return metrics like the Sharpe and Sortino ratios, and always examine the maximum drawdown to understand how the strategy performed during market downturns.

What Hidden Risks Should I Watch Out For on Retail Platforms?

Retail platforms are designed for simplicity, but this simplicity can conceal significant risks. While obvious fees are one concern, the more serious dangers often lie deeper.

Be vigilant about counterparty risk. Who is the custodian? Who is managing the strategy? If the platform cannot provide clear answers, it is a red flag. Many of these platforms also lack the granular performance data needed for a proper risk assessment, leaving you uninformed about a strategy's true volatility or historical behavior.

Ready to move beyond surface-level data? Fensory provides the institutional-grade discovery and analytics tools that serious allocators need to perform deep due diligence on BTC and stablecoin strategies. Explore a curated universe of opportunities and connect directly with product issuers today. Join the Fensory beta for free.