Crypto Backed Loans: A Guide to Unlocking Digital Asset Liquidity

Discover how crypto backed loans can provide liquidity without selling your assets. Our guide covers how they work, key strategies, risks, and CeFi vs. DeFi.

Oct 17, 2025

generated

crypto backed loans, bitcoin loans, defi lending, crypto collateral, cefi lending

Crypto-backed loans are a financial instrument allowing investors to borrow fiat currency or stablecoins by collateralizing their digital assets, such as Bitcoin or Ethereum. The core advantage is accessing liquidity without selling the underlying asset, thus preserving a long-term investment strategy.

Understanding Crypto-Backed Loans

The concept is analogous to a traditional secured loan, like a home equity line of credit. An asset’s value is used to secure a loan, providing the owner with liquid capital. As long as loan payments are met, ownership of the asset is retained.

Crypto-backed loans operate on the same principle. Instead of physical property, digital assets are pledged as collateral. This structure is particularly useful for investors who require short-term liquidity but remain bullish on the long-term appreciation of their crypto holdings. It allows them to avoid a taxable event (capital gains) and retain their market position, preventing potential loss of future upside.

This utility has driven significant market expansion. The global Bitcoin loan market was valued at approximately $1.2 billion in 2023 and is projected to reach nearly $9.8 billion by 2032, reflecting a compound annual growth rate (CAGR) of 26.4%. This growth is a direct result of widening crypto adoption and increasing allocator awareness of the strategic benefits these loans provide.

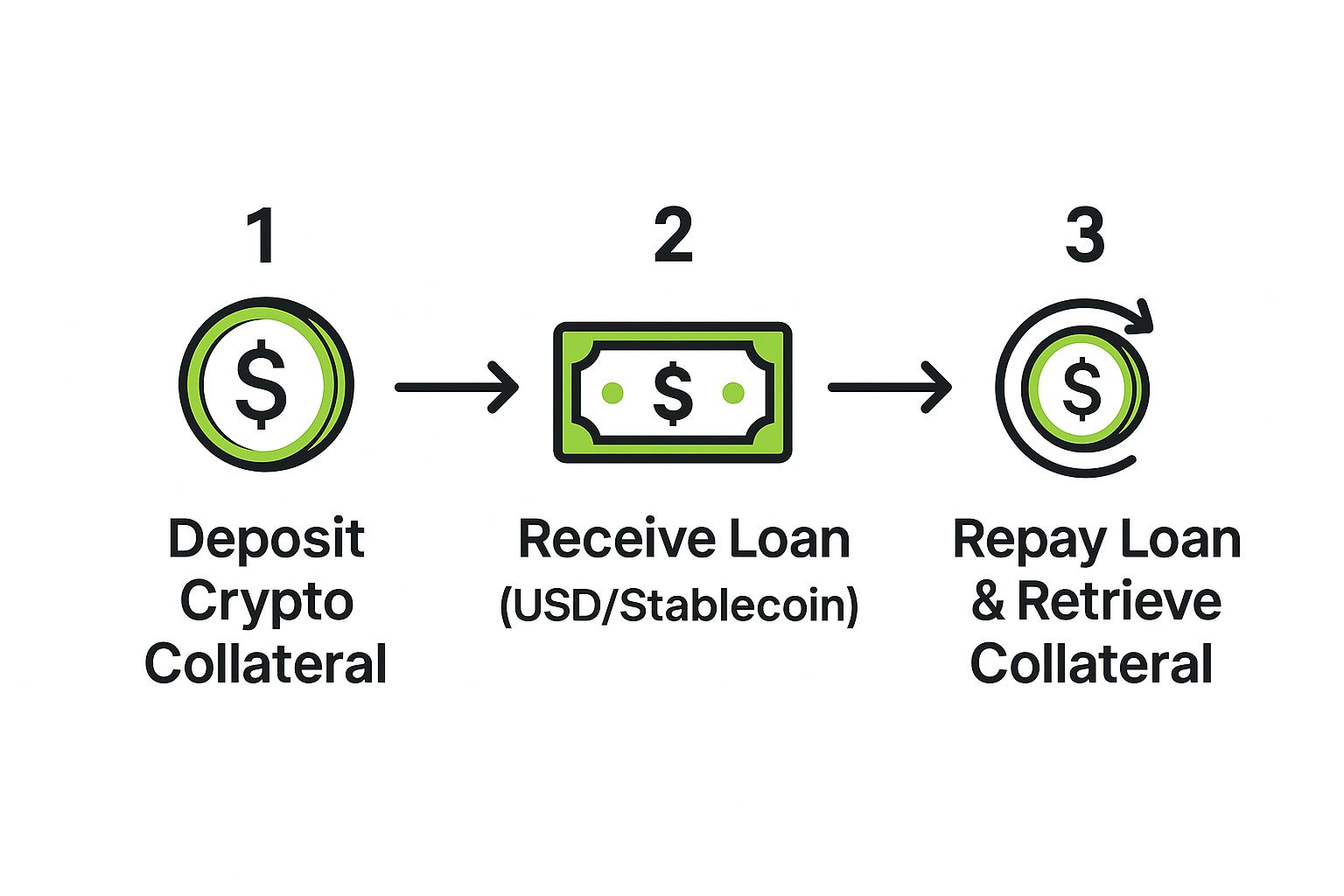

The Basic Process Flow

At a high level, the loan origination and repayment process is consistent across both centralized and decentralized platforms. It follows three primary stages, as illustrated below.

The lifecycle involves posting collateral to receive a loan and repaying the principal plus interest to reclaim the collateral. This efficient model underpins the two primary ecosystems for digital asset lending.

In essence, a crypto-backed loan turns a static digital asset into a dynamic source of capital. It’s the bridge between your crypto portfolio and your real-world financial needs, all without forcing you to liquidate.

The Two Arenas for Crypto Lending

Investors can access crypto-backed loans through two distinct types of platforms, each presenting a different risk-return profile and operational model:

Centralized Finance (CeFi): These are corporate entities that function similarly to traditional financial institutions. They take custody of user collateral and typically offer a streamlined, user-friendly experience with dedicated customer support.

Decentralized Finance (DeFi): These are protocols built on blockchains, utilizing smart contracts to automate the lending process without intermediaries. They offer greater transparency and are permissionless, but generally require more technical proficiency from the user.

Both CeFi and DeFi present compelling value propositions but involve different trade-offs regarding custody, counterparty risk, and user experience. Understanding these distinctions is a critical first step for any serious allocator evaluating these products.

How The Crypto Loan Process Actually Works

While the concept of crypto backed loans is straightforward—collateralize crypto to receive cash—the operational mechanics rely on specific metrics and automated risk management triggers that allocators must understand.

The central metric governing every crypto loan is the Loan-to-Value (LTV) ratio. This percentage represents the size of the loan relative to the market value of the posted collateral. For example, if $10,000 worth of Bitcoin is used to secure a $5,000 loan, the LTV is 50%. This ratio dictates the maximum borrowing amount and determines the margin of safety against collateral price volatility.

The Lifecycle Of A Crypto Loan

From initiation to settlement, the process follows a structured path, whether on a centralized (CeFi) or decentralized (DeFi) platform. Each step involves specific considerations.

Depositing Collateral: The process begins when the borrower transfers crypto assets (e.g., BTC, ETH) to a secure wallet or smart contract controlled by the lender. This deposit serves as the security for the loan.

Receiving The Loan: Once the platform verifies the collateral, the loan amount is disbursed. Funds are typically available in fiat currency (e.g., USD) or stablecoins (e.g., USDC) and are often credited almost instantaneously.

Managing The Position: This is the active management phase. As the market value of the collateral fluctuates, the LTV ratio changes dynamically. The borrower is responsible for monitoring this metric to ensure it remains within the lender's predetermined thresholds.

Repayment And Withdrawal: Most crypto loans offer flexible repayment schedules. Once the principal and accrued interest are fully repaid, the platform releases the collateral, which the borrower can then withdraw to their personal wallet.

Margin Calls And Liquidations Explained

The primary risks associated with crypto-backed loans are margin calls and liquidations. These are not penalties but automated risk-management mechanisms designed to protect the lender from losses if the collateral's value declines significantly.

A margin call is an initial warning. If the collateral's market price falls, the LTV ratio increases. When it reaches a predefined threshold (e.g., 75%), the lender notifies the borrower. At this point, the borrower must either add more collateral to reduce the LTV or repay a portion of the loan.

If no action is taken and the price continues to decline, the position may reach the liquidation threshold (e.g., 85% LTV). At this point, the platform's system will automatically sell a portion or all of the collateral to close out the loan. This is a forced sale. It results in the permanent loss of the sold assets and is also a taxable event.

Understanding your liquidation price is non-negotiable. It's the specific price point at which your collateral will be automatically sold. Always calculate this before taking a loan and ensure you have a plan to manage your position if the market moves against you.

A Practical Example In Action

Consider an investor seeking to borrow against 1 BTC, which has a current market value of $60,000. The lender offers a 50% LTV.

Collateral Value: $60,000 (1 BTC)

Maximum Loan Amount: $30,000 (50% of $60,000)

The platform sets its margin call at 75% LTV and liquidation at 85% LTV. The investor borrows the full $30,000.

If the price of Bitcoin drops to $40,000, the LTV would increase to 75% ($30,000 loan / $40,000 collateral), triggering a margin call.

If Bitcoin’s price falls further to approximately $35,294, the LTV becomes 85% ($30,000 / $35,294). This is the liquidation point. The platform would then sell the BTC to cover the loan, and the investor would lose their Bitcoin.

While LTV and liquidation thresholds are critical, so is the interest rate. Rates can vary significantly between platforms, so it is prudent to compare crypto interest rates to understand the total cost of borrowing.

Comparing High LTV vs Low LTV Crypto Loans

Selecting an appropriate LTV involves a trade-off between maximizing capital access and minimizing risk. A higher LTV provides more liquidity but offers a smaller buffer against market volatility, increasing the probability of liquidation. A lower LTV is more conservative but unlocks less of the collateral's value.

The table below outlines the key differences.

Feature | High LTV Loan (e.g., 70%) | Low LTV Loan (e.g., 25%) |

|---|---|---|

Borrowing Power | High. Maximizes liquidity relative to collateral value. | Low. Provides less liquidity for the same collateral value. |

Liquidation Risk | Very high. A small adverse price movement can trigger liquidation. | Very low. Requires a significant price decline to become a risk. |

Margin of Safety | Thin. Minimal buffer against market volatility. | Wide. Substantial buffer against adverse price movements. |

Ideal Use Case | Short-term, high-conviction strategies or urgent liquidity needs. | Long-term borrowing or for risk-averse allocators. |

Management Responsibility | Requires constant position monitoring. | Requires less active management. |

There is no universally "best" LTV; the optimal choice depends on an individual's risk tolerance, investment horizon, and financial objectives. For many allocators, a conservative LTV in the 25% to 40% range provides a prudent balance of useful liquidity and risk management.

How Smart Investors Are Using Crypto Loans

Understanding the mechanics of a crypto-backed loan is foundational, but analyzing their practical application reveals their strategic value. These are not merely borrowing instruments; they are tools for enhancing capital efficiency, managing tax liabilities, and capitalizing on market opportunities. Allocators from retail investors to family offices leverage them for distinct, value-driven purposes.

For many individual investors, the primary motivation is accessing liquidity without triggering a taxable event. Selling appreciated assets like Bitcoin or Ethereum realizes capital gains, which can result in significant tax obligations. Borrowing against these assets provides the necessary liquidity while deferring taxes and maintaining exposure to the asset's potential upside.

This strategy is particularly effective for large, non-recurring expenses:

Major Purchases: Funding a down payment on real estate or acquiring a vehicle without liquidating a crypto position.

Business Capital: Injecting working capital into a business or financing a new venture.

Tax Obligations: Meeting tax liabilities without being forced to sell assets at an inopportune time.

Capital Efficiency for HNWIs and Family Offices

For high-net-worth individuals (HNWIs) and family offices, crypto-backed loans serve a more sophisticated role in portfolio management. These allocators often view their digital asset holdings as long-term, strategic positions, akin to core real estate or private equity stakes. Selling is a last resort.

Instead, they use these loans to establish flexible lines of credit. This enables them to act swiftly on time-sensitive opportunities in other asset classes—such as private equity, real estate, or tactical trades in traditional markets—without the operational friction and delays of liquidating digital assets. The goal is to maximize the productivity of capital across the entire portfolio.

The name of the game for sophisticated allocators is capital efficiency. A crypto-backed loan turns a static, long-term holding into a dynamic source of cash, ready to be deployed for a strategic rebalance or a new investment at a moment's notice.

This approach offers a significant advantage. Rather than holding large cash reserves with low yields, allocators can remain fully invested while retaining access to on-demand liquidity. This preserves their core crypto strategy and enhances the agility of their overall portfolio.

Demand for such utility is growing. Coinbase alone reported facilitating over $1 billion in bitcoin-backed loans since January, a testament to the increasing desire among investors to use their crypto as productive collateral. Further insights on this trend are available from sources like CoinDesk.

Institutional Use Cases and Arbitrage

At the institutional level, strategies become more complex. Hedge funds and proprietary trading firms use crypto-backed loans to finance intricate trading strategies, such as basis trades or other market-neutral arbitrage opportunities.

For example, a fund might borrow stablecoins against its Bitcoin holdings to provide liquidity to a decentralized exchange, earning trading fees and protocol rewards. If the yield generated from this activity exceeds the interest cost of the loan, the fund creates a profitable, market-neutral position. This demonstrates how crypto-backed loans are becoming a fundamental component for sophisticated yield generation strategies, independent of market direction.

Choosing Between CeFi And DeFi Lending Platforms

The choice of where to source crypto backed loans is as critical as the decision to use one. The market is broadly divided into two ecosystems: Centralized Finance (CeFi) and Decentralized Finance (DeFi). Each operates on a different philosophy and presents unique trade-offs that influence the user experience, risk profile, and custody of collateral.

CeFi platforms are operated by corporations, structured similarly to traditional banks or brokerage firms. They typically offer polished, user-friendly interfaces and dedicated customer support, making them an accessible entry point for investors less familiar with the crypto ecosystem.

DeFi, conversely, consists of protocols—automated programs running on a blockchain. These platforms are permissionless, transparent, and governed by smart contracts that execute loan terms without intermediaries. The entire process is managed by code.

This fundamental difference creates a series of trade-offs. The appropriate choice depends on an allocator's risk tolerance, technical comfort level, and core values regarding financial services.

Comparing Custody And Counterparty Risk

The most significant distinction between CeFi and DeFi is the custody model. With a CeFi lender, the borrower transfers custody of their crypto collateral to the company. This introduces counterparty risk—the risk that the custodial entity could become insolvent, suffer a security breach, or mismanage funds, leading to a potential loss of collateral.

DeFi protocols are non-custodial. The borrower interacts directly with a smart contract, and their collateral remains locked within that protocol, visible and auditable on the blockchain. While this eliminates corporate counterparty risk, it introduces smart contract risk. A vulnerability or bug in the protocol's code could be exploited by a malicious actor, potentially resulting in the loss of funds.

The core decision is a trust trade-off. In CeFi, you trust the company and its operational security. In DeFi, you trust the integrity of the code and the underlying blockchain.

This is not a trivial decision. An allocator who prioritizes a regulated, familiar corporate structure may prefer CeFi. Conversely, a crypto-native user who values self-sovereignty and on-chain transparency will likely favor DeFi. For a more detailed examination of specific platforms, you can explore our overview of leading DeFi lending platforms.

Interest Rates And User Experience

The user experience and interest rate structures also differ significantly. CeFi platforms often provide fixed or more predictable variable interest rates, simplifying financial planning. The user experience is generally designed to be seamless, resembling a modern fintech application with intuitive dashboards and professional support.

DeFi interest rates are typically determined algorithmically based on the supply and demand of assets within a lending pool and can be highly volatile. The user experience demands greater technical sophistication, requiring users to manage their own crypto wallets and interact directly with blockchain protocols. For those considering this path, a foundational understanding of what is Decentralized Finance (DeFi) is essential.

Here is a comparative summary to guide your decision:

Feature | Centralized Finance (CeFi) | Decentralized Finance (DeFi) |

|---|---|---|

Custody Model | Custodial (Company holds your assets) | Non-Custodial (Assets locked in a smart contract) |

Primary Risk | Counterparty Risk (Company failure) | Smart Contract Risk (Code exploits or bugs) |

User Experience | Simple, user-friendly, similar to a bank | Requires technical knowledge, wallet management |

Interest Rates | Often fixed or predictably variable | Highly variable, based on supply and demand algorithms |

Transparency | Opaque; relies on corporate audits and reports | Fully transparent; all transactions are on the blockchain |

Support | Customer service teams available | Community-driven support (e.g., Discord, forums) |

Both ecosystems are experiencing significant growth. On-chain crypto-collateralized lending reached an all-time high of $26.5 billion by the end of Q2 2025, a 42% increase from the previous quarter. DeFi applications now represent approximately 49.86% of this market, with CeFi holding around 33.48%, indicating the growing adoption of decentralized solutions.

Ultimately, neither model is inherently superior; they cater to different investor profiles. The optimal choice is the one that best aligns with an allocator's individual framework for risk, convenience, and control.

A Due Diligence Framework For Managing Risk

Engaging with crypto-backed loans without a structured due diligence process is ill-advised. While these instruments offer significant capital efficiency, they also present unique risks that require careful evaluation. For high-net-worth individuals, family offices, and institutions, a rigorous due diligence framework is essential for capital preservation.

This framework should extend beyond surface-level metrics like interest rates to scrutinize the lender's operational security, custodial arrangements, and the specific terms of the loan agreement. A methodical approach enables informed decision-making.

Evaluating The Lending Platform

The initial step is a thorough vetting of the lending platform itself, whether it is a centralized company (CeFi) or a decentralized protocol (DeFi). Each requires a specific lens of analysis.

Key areas to investigate include:

Security Protocols: What measures are in place to safeguard funds and data? Look for evidence of third-party security audits, public bug bounty programs, and insurance coverage for events like hacks or theft.

Regulatory Compliance: Does the lender operate in compliance with the regulations in your jurisdiction? An ambiguous regulatory status is a significant red flag, as regulators have taken action against non-compliant crypto lenders.

Team and Track Record: Who are the individuals or entities behind the platform? Assess their experience in both finance and technology. Critically, analyze the platform's performance during periods of extreme market volatility, as this reveals its operational resilience.

Scrutinizing Loan Terms And Conditions

The loan agreement contains the precise terms that govern the relationship and often conceals critical risks within legal language. It is imperative to understand every clause, with a particular focus on the mechanics of liquidation, which can lead to permanent capital loss.

The most important number in any crypto backed loan is not the interest rate, but the liquidation threshold. A seemingly attractive loan can become a catastrophic loss if the terms allow for aggressive and unforgiving liquidations during a market dip.

Specifically, seek absolute clarity on these three points:

Liquidation Penalties: In a liquidation event, what are the associated costs beyond the forced sale of collateral? Some platforms impose additional penalties that can significantly amplify losses.

Margin Call Process: How and when will you be notified if your Loan-to-Value (LTV) ratio approaches the margin call threshold? Understand the communication channels and the timeframe allowed to remediate the position by adding collateral or repaying the loan.

Interest Rate Structure: Is the interest rate fixed or variable? If variable, what factors determine rate changes, and how frequently can they occur? An unexpected increase in the interest rate can put stress on the position.

Understanding Counterparty And Smart Contract Risk

Finally, assess the systemic risks inherent to the chosen lending model.

For CeFi platforms, the primary concern is counterparty risk. This involves the financial stability and operational integrity of the lending company. Before depositing assets, it is crucial to understand what is counterparty risk and evaluate the firm's health.

In DeFi, counterparty risk is replaced by smart contract risk. The danger lies not in corporate mismanagement but in a potential vulnerability within the protocol's code that a hacker could exploit. For any DeFi protocol, confirm that its smart contracts have been audited by multiple reputable cybersecurity firms.

Additionally, tax implications are a critical component of due diligence. Be sure to consult with a professional on navigating cryptocurrency tax obligations, as a liquidation event is typically a taxable disposition of the asset. This comprehensive approach ensures an evaluation of not just the loan product, but the entire ecosystem supporting it.

What's Next for Digital Asset Lending?

The landscape for crypto-backed loans is not static. It is a dynamic arena where financial structures are evolving in sophistication and integration with the broader financial system. The future is characterized not just by the proliferation of DeFi protocols, but by a convergence of traditional finance principles with the efficiency of blockchain technology. This is where significant opportunities for capital allocators are emerging.

Institutional adoption is a primary catalyst for this evolution. As hedge funds, asset managers, and other institutional players expand their digital asset allocations, their demand for sophisticated capital efficiency tools—such as crypto-backed lending—will intensify. This influx of institutional capital is expected to bring greater liquidity, tighter spreads, and more standardized products to the market, signaling its maturation.

Tokenization is Unlocking New Forms of Collateral

Another powerful driver is the tokenization of Real-World Assets (RWAs). This innovation enables physical or traditional financial assets, such as real estate or private credit, to be represented as digital tokens on a blockchain. These tokens can then be used as collateral, bridging the gap between the digital and physical economies and dramatically expanding the potential collateral base beyond volatile cryptocurrencies.

Expanded Borrowing Power: Investors could unlock liquidity from historically illiquid assets.

Diversified Risk: Lenders can accept a wider range of collateral, reducing their systemic risk exposure to the price volatility of a few major crypto assets.

New Financial Products: This will foster the development of hybrid financial instruments that combine the speed and transparency of on-chain settlement with the value of tangible, off-chain assets.

This trend is poised to make digital asset lending platforms more robust and attractive to traditional allocators who are familiar with asset-backed financing but may be hesitant to engage with purely digital collateral.

Why Regulatory Clarity is the Foundation for Growth

The evolving regulatory landscape is moving toward providing greater clarity and structure for the digital asset industry. As these frameworks mature, they will establish clearer consumer protections and operational standards for lenders. While sometimes viewed as a constraint, this process is a critical step in legitimizing the industry and building institutional trust.

A clear and predictable regulatory environment isn’t a barrier to growth; it's the foundation upon which a stable, scalable market for digital asset lending will be built. It provides the guardrails necessary to attract significant, risk-averse institutional capital.

Effective regulatory oversight will help mitigate systemic risk and marginalize irresponsible actors, creating a safer and more stable market for all participants. Over time, the lines between CeFi and DeFi will likely blur, with platforms adopting hybrid models that offer the transparency of DeFi combined with the compliance and user experience of CeFi.

In summary, the future of digital asset lending is one of increasing complexity and opportunity. The instruments will become more powerful, the collateral more diverse, and the platforms more regulated. For allocators, this translates to more ways to achieve capital efficiency, but it also reinforces the non-negotiable requirement for rigorous due diligence and proactive risk management.

What Happens If My Collateral Value Drops?

This is the most critical risk to understand. If the market value of your collateral declines, your Loan-to-Value (LTV) ratio will rise. Lenders have automated systems to manage this risk.

First, you will receive a margin call, which is an alert that your LTV has crossed a predefined warning threshold. At this stage, you have the opportunity to take action by either:

Adding more collateral to your position to lower the LTV.

Repaying a portion of the loan in cash or stablecoins.

If you do not take action and the market continues to decline, your position may reach the liquidation threshold. At this point, the lender's system will automatically sell a sufficient amount of your collateral on the open market to repay the loan and associated fees. This is a forced and final sale.

Are Crypto-Backed Loans a Taxable Event?

In most jurisdictions, taking out a loan is not a taxable event. This is a key benefit, as it allows you to access liquidity from your digital assets without triggering a capital gains tax event associated with a sale.

However, a liquidation of your collateral is a taxable event. A liquidation is a forced sale, and this disposition of your asset will likely be subject to capital gains or loss treatment depending on your cost basis and jurisdiction.

Disclaimer: Tax laws concerning digital assets are complex and vary by jurisdiction. It is imperative to consult with a qualified tax professional who specializes in digital assets before engaging in these transactions.

Which Cryptocurrencies Can I Use as Collateral?

The types of accepted collateral vary by lender. Bitcoin (BTC) and Ethereum (ETH) are the most widely accepted forms of collateral due to their high liquidity and large market capitalization.

Many larger lending platforms also accept other established, large-cap digital assets and major stablecoins. It is essential to check directly with a specific platform to confirm their list of accepted collateral for crypto-backed loans.

Ready to discover and analyze the best BTC and stablecoin investment products in one place? Fensory provides the institutional-grade terminal for allocators to perform due diligence, compare strategies, and connect with managers. Join the closed beta for free at https://fensory.com.