A Guide to Decentralized Finance Protocol Investing

Discover how a decentralized finance protocol works, its core components, and how to evaluate risks. Your guide to navigating the DeFi landscape.

Oct 21, 2025

generated

decentralized finance protocol, DeFi, blockchain finance, crypto investing, smart contracts

A decentralized finance protocol is an automated financial application running on a blockchain. It's powered by self-executing code called smart contracts that facilitate lending, trading, and earning yield—all without a bank, broker, or other traditional intermediary.

Think of it as a financial vending machine. It's transparent, runs 24/7, and is accessible to anyone with an internet connection.

What Is a Decentralized Finance Protocol?

At its core, a decentralized finance protocol re-engineers financial services. It replaces centralized institutions with autonomous code. Instead of navigating a bank's lengthy underwriting process for a loan, a user interacts directly with a lending protocol that operates on a clear, unchangeable set of rules.

This approach fundamentally alters how capital is managed, shifting from a system based on trust in institutions to one based on verifiable code. In traditional finance, you trust a bank to hold your funds and process transactions correctly. In DeFi, that trust is placed in the mathematics and software running on the blockchain.

This infographic illustrates the concept, showing how a protocol acts as a direct link between users and financial services, with code as the only intermediary.

It’s a foundational shift from human-gated finance to automated, open-access networks.

The Shift from Intermediaries to Code

Traditional financial institutions act as gatekeepers, controlling who gets a loan, setting fees, and managing the flow of capital. A decentralized finance protocol removes these intermediaries. Every operation is handled by smart contracts, which are pieces of code that execute automatically when predefined conditions are met.

This automation creates a more accessible and efficient financial system with several key characteristics:

Permissionless Access: Anyone with a crypto wallet can use a DeFi protocol, regardless of their location or financial status. This enables a truly global user base.

Radical Transparency: Built on public blockchains, every transaction and rule is publicly auditable in real-time.

User Sovereignty: Users maintain control over their assets. Funds remain in a personal wallet and only move when authorized by the user.

In essence, DeFi protocols are not companies; they are open-source markets. They provide the infrastructure for peer-to-peer financial activities to occur directly, efficiently, and transparently on a global scale.

This foundation supports a new wave of financial products and strategies. The removal of centralized control is the single most important feature, unlocking both the unique opportunities and the inherent risks of this space.

Understanding The Building Blocks Of DeFi Protocols

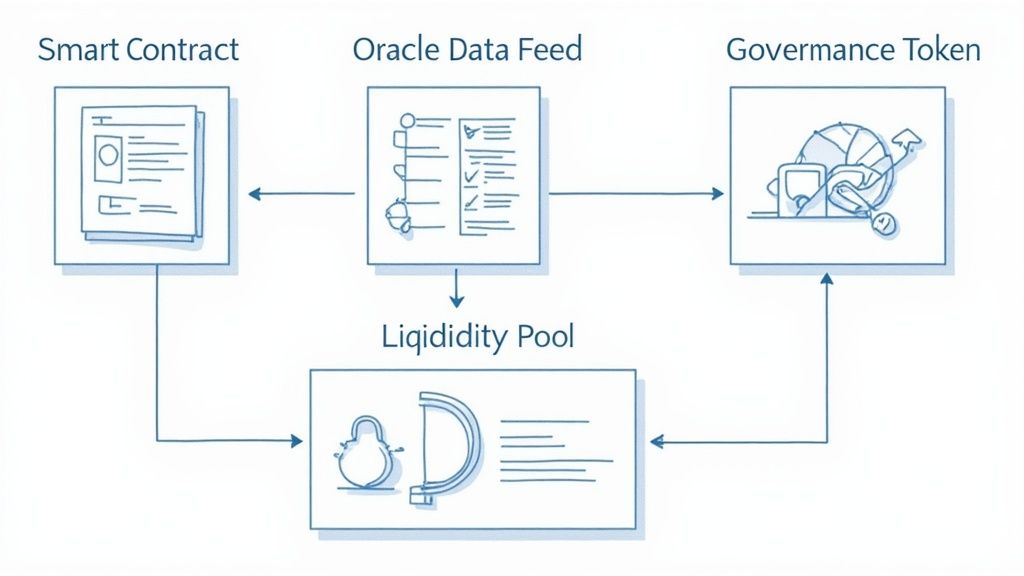

To understand how a DeFi protocol functions, one must examine its architecture. These platforms are not monolithic applications but are constructed from several interlocking components that deliver financial services without a bank or broker.

Demystifying these core components clarifies the operational mechanics of the system.

At the base is the blockchain—an immutable, public ledger that records all transactions. Layered on top are smart contracts, the engine of any protocol. These are self-executing pieces of code that enforce the rules for everything from a simple trade to a complex loan.

The blockchain serves as a hyper-secure public record book, while smart contracts act as automated clerks, ensuring every entry adheres strictly to the rules. This combination creates the trust and predictability upon which the DeFi ecosystem is built.

Smart Contracts: The Automated Rulebook

Smart contracts eliminate the need for traditional financial intermediaries. They are deterministic, meaning they perform exactly as programmed every time. Once deployed on a blockchain, they cannot be tampered with or altered.

This automation allows a lending protocol to issue a loan or a decentralized exchange to swap assets instantly, without human intervention. The terms—such as collateral requirements or trading fees—are embedded directly into the code, creating a transparent and level playing field.

A smart contract is not analogous to a legal document requiring interpretation. It is more like a vending machine: you input a specific crypto asset, and it is hardwired to dispense a specific output, such as a loan or another asset, in return. No negotiation, no delays.

This programmability allows developers to build sophisticated financial tools in a permissionless environment that fosters innovation.

Oracles: The Data Messengers

By design, blockchains are closed systems. They excel at tracking on-chain events but lack awareness of external, real-world information. This presents a challenge for financial applications that require data like the current price of Apple stock or the value of the U.S. dollar.

Oracles solve this problem. They are secure data feeds that act as a bridge, delivering external information into smart contracts. They connect the on-chain world of DeFi to the off-chain data it relies on. A lending protocol, for instance, uses an oracle to constantly monitor the real-time value of a user's collateral to ensure loans remain sufficiently collateralized.

Liquidity Pools: The Community's Capital

Many DeFi protocols, particularly decentralized exchanges (DEXs), have replaced the traditional order book model for matching buyers and sellers with liquidity pools.

Imagine a large, community-sourced pool of capital for a specific trading pair, like ETH and USDC. Users, known as liquidity providers (LPs), deposit their assets into this pool. In exchange for providing this capital, they earn a share of the trading fees. This model ensures a ready supply of assets for trades to execute instantly and automatically.

Governance Tokens: The Voting Shares

Finally, many DeFi protocols are governed by their users through governance tokens. Holding these tokens is analogous to owning shares in a company—it grants the right to vote on key decisions that shape the protocol's future. This can include anything from upgrading smart contracts to altering the fee structure.

This approach decentralizes control, transforming users from passive customers into active stakeholders with a direct influence on the protocol's operation. To learn more about different digital asset types, see our guide on what is a crypto token.

Key Components of a Decentralized Finance Protocol

A summary of the essential technological layers that enable DeFi protocols to function and their primary roles within the ecosystem.

Component | Analogy | Function |

|---|---|---|

Blockchain | A digital public ledger | Provides a secure, transparent, and immutable foundation for recording all transactions. |

Smart Contracts | An automated vending machine | Self-executing code that enforces the protocol's rules without intermediaries. |

Oracles | A secure data bridge | Feeds essential real-world, off-chain data (like asset prices) into smart contracts. |

Liquidity Pools | A community-owned pot of capital | Allows for automated and efficient trading by pooling user-supplied assets. |

Governance Tokens | Voting shares in a company | Grants token holders the right to vote on and influence the protocol's development. |

Each of these building blocks plays a critical role. Without them, the decentralized, transparent, and user-owned financial system that DeFi promises could not exist.

The Economic Model of DeFi Value Creation

Understanding the technology behind a DeFi protocol is one thing, but for allocators, the critical question is: how is value generated? How do these smart contracts and blockchains create tangible economic benefits and new investment opportunities?

The value of DeFi stems from its new economic model, which generates value by eliminating the inefficiencies inherent in traditional finance. It replaces a system of gatekeepers and intermediaries with open, permissionless financial infrastructure. This fundamental shift unlocks several key advantages that are attracting attention from retail investors to institutional allocators.

Financial Inclusion

Traditional finance can be an exclusive system where access to quality financial products often depends on geography, net worth, or personal connections. DeFi offers a more inclusive alternative.

Because these protocols operate on public blockchains, anyone with an internet connection and a crypto wallet can access global markets for lending, trading, and earning yield. This expands the potential user base by billions, particularly in emerging economies where traditional banking infrastructure is less developed. For an allocator, this means access to a truly global liquidity pool.

Radical Transparency and Efficiency

Traditional finance often operates with opaque fee structures, and transaction settlement can take days as it passes through multiple intermediaries, each taking a fee. DeFi inverts this model.

Every transaction, rule, and piece of collateral in a DeFi protocol is recorded on a public blockchain, available for anyone to audit at any time. This creates a level of unprecedented transparency that is unattainable in traditional systems.

By replacing manual processes with automated smart contracts, these protocols achieve remarkable efficiency, which translates into direct benefits for users:

Lower Fees: Trading or lending often costs a fraction of what a bank or broker would charge.

Near-Instant Settlement: Transactions are confirmed in minutes, not days.

Competitive Rates: With reduced overhead, lenders can earn more, and borrowers can access more favorable rates.

The "Money Legos" Effect

One of the most powerful concepts in DeFi is composability. Each protocol can be thought of as a financial "money lego." Because they are open-source, developers can combine these legos to build new and more sophisticated financial instruments.

For instance, a developer could connect a lending protocol to a decentralized exchange to create an automated strategy that borrows one asset to generate yield with another. This interoperability creates a powerful network effect—as more legos are added, the potential for innovation grows exponentially.

Composability is the engine of DeFi innovation. It allows for rapid, permissionless experimentation, enabling the creation of complex financial products at a speed and scale that is impossible within the walled gardens of traditional finance.

This means new investment strategies can emerge quickly, offering allocators a constantly evolving menu of opportunities. It’s a dynamic, creative space where the next financial innovation can be built by remixing battle-tested components.

User Control Over Capital

Arguably the most important aspect of DeFi is that it returns financial control to the individual. When using a DeFi protocol, assets remain in the user's personal wallet, secured by their private key. Only the user can authorize their movement.

This concept of user sovereignty is a significant departure from the traditional model, which requires trusting a bank or brokerage with your funds. In DeFi, trust is placed in the code, not in a person or institution. For any investor concerned about counterparty risk, this model of self-custody is a game-changer, offering a direct and powerful way to manage assets.

Mapping the Different Types of DeFi Protocols

The DeFi ecosystem is not a monolithic market but a diverse collection of specialized financial applications, each with its own purpose, user base, and risk profile. For allocators, understanding these distinct categories is the first step in identifying where a strategy fits.

Navigating this landscape is like exploring a new city; a map is needed to understand the key districts and their offerings. The most established "districts" in DeFi replicate and often improve upon core services from traditional finance. These are the workhorses of the on-chain economy, facilitating the majority of activity and capital flow.

By breaking down these primary categories, we can build a practical framework for evaluating where and how to allocate capital in this dynamic environment.

Decentralized Exchanges (DEXs)

Decentralized Exchanges (DEXs) are the open marketplaces of the DeFi world. Unlike centralized exchanges such as Coinbase or Binance, a DEX protocol like Uniswap operates without a central company or intermediary order book. They are powered by automated market makers (AMMs) and liquidity pools, which allow for direct, peer-to-peer asset swaps.

Their primary function is to enable permissionless trading. For an investor, the appeal is clear: immediate access to a wide array of tokens, self-custody of funds at all times, and the opportunity to earn trading fees by providing liquidity. This makes DEXs attractive to active traders, arbitrageurs, and long-term holders looking to put their assets to work.

Lending and Borrowing Platforms

Lending protocols function as the decentralized banks of this new financial system. Platforms like Aave allow users to deposit assets into lending pools to earn interest or borrow against their deposited collateral. All operations are handled by smart contracts—from setting interest rates based on supply and demand to liquidating collateral if a loan becomes undercollateralized.

These platforms are focused on capital efficiency. An investor can earn passive yield on idle assets like Bitcoin or stablecoins, often at rates that surpass those of traditional savings accounts. Simultaneously, borrowers can access liquidity without selling their holdings—a critical tool for traders and fund managers. You can explore the mechanics further in our guide to DeFi lending platforms.

For many allocators, lending protocols are a familiar and comfortable entry point into DeFi. They offer a straightforward value proposition—earning yield on capital—that directly mirrors services in traditional finance, but with the added benefits of on-chain transparency and automation.

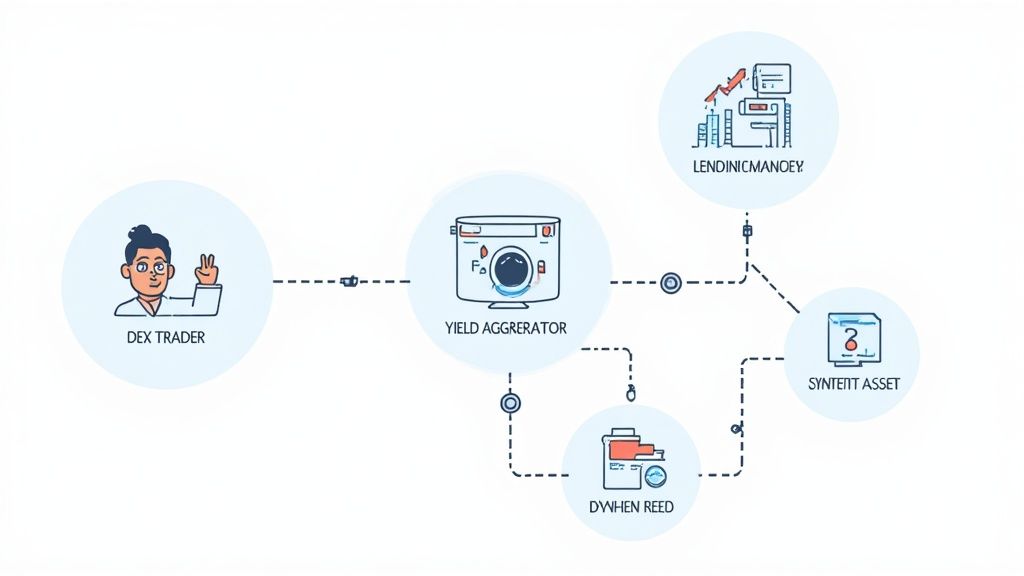

Yield Aggregators and Optimizers

While lending protocols offer yield, yield aggregators are designed to automatically find the best available yield across the DeFi landscape. They function like robo-advisors for crypto assets. A protocol like Yearn Finance takes user deposits and deploys them into complex, pre-built strategies designed to maximize returns.

These strategies might involve lending on one platform, providing liquidity on another, and constantly rebalancing capital to capture the highest rates. For an investor, the value is simplification and optimization. Instead of manually researching and moving funds, a yield aggregator performs the heavy lifting. This makes them well-suited for passive investors, including HNWIs and family offices, who want efficient exposure to DeFi yields without becoming full-time strategists.

Comparison of Major DeFi Protocol Categories

To summarize, here is an overview of how these core DeFi building blocks compare. Each serves a distinct audience with a unique approach to value generation.

Protocol Type | Primary Function | Leading Example | Target User Profile |

|---|---|---|---|

DEXs | Facilitate permissionless, peer-to-peer asset swaps via automated liquidity pools. | Active traders, arbitrageurs, and liquidity providers. | |

Lending & Borrowing | Enable users to earn interest by supplying assets or borrow against collateral. | Passive income seekers, long-term holders, and traders. | |

Yield Aggregators | Automate strategies to find and compound the best yields across DeFi platforms. | Passive investors, HNWIs, and those seeking optimized returns. |

Understanding this landscape is foundational. From here, one can begin to see how these protocols interlock, creating a rich, composable system where the whole is often greater than the sum of its parts.

A Framework for Evaluating DeFi Protocol Risks

While the potential of DeFi is significant, a prudent allocator must look beyond the hype and approach the space with a structured, clear-eyed view of potential risks. The absence of banks and brokers does not mean an absence of risk—it simply changes its nature.

A robust due diligence framework requires systematically dissecting every potential point of failure. For investors from traditional finance, this demands a new mindset. Instead of evaluating management teams and balance sheets, one must audit smart contracts and analyze on-chain activity. The goal is to build a complete risk profile before deploying capital.

Technical and Security Risks

The greatest vulnerability in DeFi is technical. A protocol is only as strong as its underlying code. Bugs, logic errors, or hidden vulnerabilities can be exploited by attackers, often leading to a total and irreversible loss of funds.

Another critical technical weak point is the oracle. These data feeds provide a protocol with external information, such as the current price of ETH. If an oracle is compromised or provides inaccurate data, it can trigger catastrophic events, such as a wave of wrongful liquidations in a lending market.

To mitigate these risks, it is essential to use protocols that have undergone multiple, independent security audits from reputable firms. While not a guarantee, it is a critical first step. For a deeper dive, our guide on on-chain analysis explains how to monitor a protocol’s health and transaction patterns in real-time.

Economic and Market Risks

Sound code is not enough. Every DeFi protocol is also an economic system that must be stress-tested. These risks relate to the financial incentives built into the system and its resilience during market volatility.

Key economic risks to consider include:

Impermanent Loss: This risk is unique to providing liquidity in Automated Market Makers (AMMs). It occurs when the value of deposited tokens becomes less than if they had simply been held in a wallet, which can happen when the price of one asset moves dramatically relative to the other.

Asset Volatility: Many DeFi protocols use volatile crypto assets as collateral. A sudden market downturn can trigger a cascade of liquidations, creating systemic risk that could threaten the protocol's solvency.

Governance Attacks: In protocols governed by a token, an actor who acquires a majority stake could theoretically vote to change the rules for personal gain, such as draining the treasury.

A protocol’s resilience depends not just on secure code but also on a robust economic design that can withstand market stress. This includes effective liquidation mechanisms and diversification of collateral types.

The growing scale of the DeFi market underscores the importance of understanding these risks. With significant capital flowing into the ecosystem, rigorous risk assessment is non-negotiable. You can find more details in these DeFi's future growth projections.

Operational and Regulatory Risks

Finally, operational and regulatory risks must not be overlooked. First, personal operational security is paramount. In DeFi, the user is their own bank. The responsibility for securing private keys lies entirely with the individual. If keys are lost or compromised, assets are gone forever, with no recourse.

The regulatory environment is another significant uncertainty. Governments worldwide are still developing frameworks for DeFi. A sudden regulatory change could impact a protocol's legality, its token's value, and its long-term viability. This remains one of the largest and most unpredictable risks.

The Future of Decentralized Finance

The world of decentralized finance is in a constant state of evolution, driven by user demand and technological advancements. For allocators, understanding its trajectory is key to identifying opportunities before they become mainstream.

The next phase for any serious DeFi protocol involves bridging the gap between the on-chain economy and the traditional financial system. This means solving scalability challenges and improving accessibility for users beyond crypto natives.

These developments are not distant possibilities; they are already underway, driven by key trends that are reshaping the investment landscape.

Bringing Real-World Assets On-Chain

Perhaps the most significant shift is the tokenization of Real-World Assets (RWAs). This involves bringing tangible, off-chain assets—such as private credit, real estate, and government bonds—onto the blockchain. By converting these assets into digital tokens, protocols can unlock vast amounts of liquidity and create entirely new financial products.

For an institutional investor or a family office, this is a transformative development. It enables exposure to traditionally illiquid asset classes with the transparency and efficiency of DeFi. Imagine a portfolio manager using tokenized U.S. Treasuries as collateral in a lending protocol to borrow stablecoins. This allows for highly efficient capital structures that were not previously possible.

This is how DeFi matures from a crypto-native niche into a fundamental layer of global finance.

The tokenization of RWAs is the next frontier. It merges trillions of dollars in traditional assets with the automated, transparent, and efficient rails of blockchain technology, making real-world value programmable.

Solving Scalability with Layer 2s

Early DeFi was often hindered by slow transaction speeds and high costs on congested blockchains. Layer 2 solutions address this issue. They process transactions on separate, faster networks before bundling them and settling them on the main blockchain.

The result is a dramatic reduction in fees and a significant increase in transaction speed, making DeFi practical for a much wider audience. For allocators, this means strategies can be executed more cost-effectively and opens the door to new, high-frequency applications.

Ultimately, a seamless user experience is the final barrier to mass adoption. As Layer 2s make DeFi cheaper and faster, and as user interfaces become more intuitive, the complexity that once deterred mainstream capital is diminishing. This improved accessibility, combined with growing institutional demand for compliant on-chain products, points toward a financial system that is becoming more integrated, efficient, and open.

Common Questions About DeFi Protocols

Even for experienced investors, the mechanics of a DeFi protocol can raise important questions. Clarifying these points is essential for building conviction and making informed allocation decisions. Here are answers to some of the most common questions from allocators exploring this space.

How Do Decentralized Finance Protocols Generate Revenue?

DeFi protocols are not non-profits; they generate revenue by charging small, transparent fees for their services. Unlike a bank's often complex and opaque fee schedule, a protocol's revenue model is embedded directly in its smart contracts for public verification.

For example, a decentralized exchange (DEX) typically charges a small percentage on every trade. A portion of this fee is distributed to liquidity providers as a reward for their capital, while the remainder may be allocated to a community-governed treasury to fund protocol development and growth. Lending protocols operate similarly, earning a small spread between the interest paid by borrowers and the rate paid out to lenders.

Because these platforms operate on code with minimal overhead—no physical branches or large payrolls—their fees are often significantly lower than those in traditional finance.

Is My Capital Secure in a Decentralized Finance Protocol?

Security in DeFi operates under a different paradigm. The risks are not related to institutional failure or mismanagement as in traditional finance. Instead, the primary threats are technical. Every DeFi protocol runs on smart contracts, and this code can contain undiscovered bugs or vulnerabilities. Malicious actors actively search for these flaws, and a successful exploit can result in a rapid, irreversible loss of funds.

The guiding principle for DeFi security is "don't trust, verify." This means relying on objective evidence, such as professional security audits and on-chain data, rather than a brand's reputation.

To mitigate this, any reputable protocol undergoes multiple, rigorous security audits from specialized firms. Before deploying capital, allocators should review a protocol’s audit history, check for active bug bounty programs, and assess the development team's track record. Many also take additional precautions, such as using smart contract insurance or diversifying funds across several well-vetted protocols to avoid over-concentration of risk.

Do I Need to Be a Crypto Expert to Use a DeFi Protocol?

While a basic understanding of how to use a crypto wallet and approve blockchain transactions is necessary, you do not need to be a developer or a crypto expert. The user experience in DeFi has improved dramatically. Many platforms now feature clean, intuitive dashboards that resemble modern fintech applications more than the complex command-line interfaces of the past.

However, the key difference is that the user is entirely responsible for their own security. This includes safeguarding private keys and understanding the permissions granted when interacting with a decentralized finance protocol. For those new to the space, a prudent approach is to start small. Begin by deploying a small amount of capital on established, heavily audited platforms. This allows one to become comfortable with the process and the necessary security practices before committing more significant resources.

Ready to cut through the noise and find institutional-grade opportunities in the BTC and stablecoin markets? Fensory provides the smart discovery tools, real-time data, and direct manager access you need to make informed allocation decisions. Join the closed beta for free and see the full landscape. Learn more at Fensory.