What Is Spot Crypto Trading? A Practical Explainer for Allocators

Uncover what is spot crypto trading in this clear guide. Learn how spot markets work, why ownership matters, and how it differs from futures trading.

Oct 14, 2025

generated

what is spot crypto, spot trading, crypto investing, crypto markets, bitcoin trading

For any allocator entering the digital asset space, understanding the term "spot trading" is fundamental. So, what is spot crypto trading?

In simple terms, spot crypto trading is the direct purchase or sale of digital assets like Bitcoin or Ethereum for immediate settlement. It's a straightforward transaction: an allocator pays the current market price and receives the actual cryptocurrency in their account almost instantly. This is analogous to buying shares of a company on a traditional exchange—you pay the agreed-upon price, and the shares are delivered to your custody.

Understanding Spot Crypto Trading

At its core, a spot trade is a simple agreement between a buyer and a seller. They agree on a price—the spot price—and the transaction is settled immediately. Once an order is filled, the asset and payment are exchanged "on the spot," hence the name. This mechanism forms the bedrock of the digital asset market.

Consider a familiar analogy from traditional finance: a foreign exchange transaction. An investor walks up to a currency exchange desk, provides US dollars, and receives euros at the current exchange rate. That is a spot transaction. It's a direct, immediate swap of one asset for another, with no complex contracts or future settlement dates involved.

To provide a clear framework, the table below breaks down the core concepts of spot trading.

Spot Trading Core Concepts at a Glance

Concept | Description |

|---|---|

Spot Price | The current market price of a cryptocurrency, determined by real-time supply and demand on an exchange. |

Immediate Delivery | The transaction settles almost instantly. Once an order is filled, the assets are delivered to the account. |

Direct Ownership | The buyer takes direct custody of the underlying crypto asset and can withdraw it to a private wallet or deploy it in other strategies. |

Order Book | A real-time ledger of all buy and sell orders for a specific crypto pair, which determines the spot price. |

These fundamental principles make spot trading the primary method for most participants entering the crypto market.

The Pillars of Spot Trading

This direct-exchange model is built on a few core principles that make it essential for both individual investors and large financial institutions. Understanding these is the first step toward confidently navigating the crypto ecosystem.

Here are the key mechanics:

Direct Ownership: When an allocator buys Bitcoin on the spot market, they take ownership of the underlying BTC. The asset can be withdrawn from the exchange into a self-custody wallet, transferred, or held as a long-term position.

Immediate Settlement: Spot trades settle in near real-time. As soon as a buyer and seller are matched, the transaction is finalized, and the crypto appears in the account balance, ready for its next use.

Market-Driven Prices: The spot price is not arbitrary; it is a dynamic figure set by the collective actions of thousands of market participants. It represents the real-time equilibrium point between demand (bids) and supply (asks).

A spot market transaction is the simplest form of trading. It provides direct exposure to an asset's price movements and is the primary method for long-term allocators to build a position in cryptocurrencies like Bitcoin or Ethereum.

For investors seeking a deeper understanding of trading fundamentals, a valuable resource is vTrader's Academy for more educational content. For now, the key takeaway is that direct ownership via spot markets is how most global investors initiate their crypto allocations.

How a Spot Crypto Trade Actually Works

While the interface may appear complex, the mechanics of a spot crypto trade are quite straightforward. Every trade occurs on an exchange, which functions as a digital marketplace for buyers and sellers globally.

Let's break down the process with a classic example: purchasing Bitcoin (BTC) with US Dollars (USD).

The entire system is structured around trading pairs, such as BTC/USD. This notation indicates precisely what is being exchanged. In this case, an investor is either using USD to buy BTC or selling BTC to receive USD. The quoted price for BTC/USD is the live spot price—the exact cost in dollars to acquire one Bitcoin at that moment.

The Order Book: The Heart of the Market

At the center of any exchange is the order book. This is a transparent, continuously updated ledger of every buy and sell order for a given trading pair. It provides a real-time view of market sentiment, showing what prices participants are willing to pay and at what prices others are willing to sell.

The order book has two sides:

Bids (Buy Orders): This represents the "demand" side. It is a list of all traders seeking to buy the asset, detailing the price they are offering and the quantity they wish to purchase. The highest price on this list is the "highest bid."

Asks (Sell Orders): This represents the "supply" side. It shows all participants looking to sell, the price they are asking for, and the quantity they have available. The lowest price here is the "lowest ask."

The small difference between the highest bid and the lowest ask is known as the spread. In a highly liquid market, this spread is typically minimal, which indicates a healthy and efficient trading environment.

The depth of an order book is a critical indicator of market health. A "deep" book has numerous buy and sell orders stacked at various price levels. This allows large trades to be executed without causing significant, sudden price movements.

For traders and funds requiring a more granular view, it is possible to analyze Level 2 market data, which displays the full depth of the order book beyond just the top bid and ask.

Market Orders vs. Limit Orders

When executing a trade, an allocator must choose an order type. The two most common options—market and limit orders—achieve the objective in fundamentally different ways.

A market order prioritizes execution speed. It instructs the exchange to buy or sell immediately at the best available price. A market buy for BTC will be instantly matched with the lowest sell orders (the lowest asks) until the order is completely filled. This method is simple and fast.

A limit order, conversely, prioritizes price control. The allocator sets the exact price at which they are willing to transact. A limit buy order will remain pending and will only execute if the market price drops to the specified level. Similarly, a limit sell order only executes if the price rises to meet the target.

The choice between them is a classic trade-off. Market orders guarantee execution but may be subject to price slippage. Limit orders provide price precision but offer no guarantee of execution if the market moves away from the specified price.

The Key Players in Spot Crypto Markets

A healthy crypto market is a dynamic ecosystem of diverse participants, each playing a specific role that contributes to its overall efficiency, from providing liquidity to enabling price discovery.

To understand how these markets function, it is essential to know who these players are and their respective functions. They range from individual retail investors to large institutions executing multi-million dollar trades.

Retail and Institutional Traders

Traders are the most visible participants and typically fall into two categories.

Retail Traders: This group includes individual investors using personal capital to buy and sell crypto. It encompasses a wide spectrum, from long-term investors who "HODL" their assets to active day traders seeking to profit from short-term price fluctuations.

Institutional Investors: This category includes hedge funds, family offices, and proprietary trading firms. These are sophisticated allocators dealing in volumes large enough to impact the market if not managed carefully. They employ complex strategies and require deep liquidity pools for efficient execution.

When an institution needs to execute a large trade without causing significant market impact, it often turns to over-the-counter (OTC) crypto trading, where large-volume deals can be negotiated privately.

Exchanges: The Central Hubs

Centralized exchanges (CEXs) are the foundation of the spot market. These platforms serve as trusted intermediaries, connecting buyers and sellers. Their responsibilities include managing the order book, matching trades, and providing custody for user funds.

A centralized exchange acts as the digital town square for the crypto economy. It's where supply meets demand in a transparent, real-time environment, providing the critical price signals that the entire market relies on.

Exchanges are the primary venues for price discovery. The competition among them is fierce, with trading volume serving as the key performance metric. For example, despite regulatory challenges in late 2023, Binance maintained its position as the top exchange, frequently processing more than double the volume of its closest competitor into early 2025. You can discover more insights about exchange market share.

Market Makers: The Liquidity Providers

Operating behind the scenes are the market’s crucial liquidity providers: market makers. These are typically high-frequency trading firms that ensure market fluidity by continuously placing both buy (bid) and sell (ask) orders for an asset.

By standing ready to trade on both sides, they ensure there is nearly always a counterparty for any trade. This practice narrows the bid-ask spread and facilitates frictionless trading for all other participants. Without market makers, order books would be thin, spreads would be wide, and trading would be inefficient and costly.

Why Stablecoins Are the Engine of Spot Trading

If centralized exchanges are the marketplaces of the crypto economy, then stablecoins are the universal currency used for transactions. While one can certainly buy Bitcoin with US dollars (the BTC/USD pair), the vast majority of trading volume occurs through stablecoin pairs like BTC/USDT or ETH/USDC.

These digital assets are designed to maintain a stable value, typically pegged 1:1 to a major fiat currency like the US dollar. This stability makes them the ideal bridge between traditional finance and the 24/7 crypto market. They provide traders with a reliable unit of account and a dependable medium of exchange, mitigating the volatility risk associated with using a cryptocurrency like Ethereum as the quote currency in a trade.

The Foundation of Market Liquidity

The primary reason stablecoins dominate spot markets is liquidity. Trading pairs that utilize Tether (USDT) or USD Coin (USDC) consistently have the deepest order books and the tightest spreads. For an allocator, this means large trades can be executed with minimal price impact (slippage). This is a critical requirement for all market participants, from retail traders to large institutional funds.

This deep liquidity creates a positive feedback loop. Traders are drawn to stablecoin pairs for their efficiency, which in turn incentivizes market makers to provide even more liquidity. This cycle has established stablecoins as the default financial plumbing for the industry. To delve deeper into their mechanics, you can explore our guide on what stablecoins are.

Stablecoins act as the digital dollar for the crypto economy. They enable near-instant, low-cost capital movement between exchanges globally, allowing traders and allocators to capitalize on opportunities without the delays and costs of traditional banking rails.

This is not merely a convenience; it is the core infrastructure enabling the free flow of capital across a global, decentralized market.

A Look at the Transaction Volume

Stablecoins have become the undisputed backbone of spot crypto trading, enabling global settlement and liquidity on a massive scale. The data is compelling. Between June 2024 and June 2025, Tether (USDT) consistently processed over $1 trillion in monthly transaction volume, reaching a peak of $1.14 trillion in January 2025.

During the same period, USD Coin (USDC) volumes were even more significant, ranging from $1.24 trillion to $3.29 trillion in a single month. For a comprehensive analysis, you can read the full research about these transaction volumes.

This immense volume highlights their importance. For institutional investors and family offices, stablecoins offer a regulated and highly efficient method for moving capital on-chain, deploying it into various strategies, and settling trades—all without reverting to the legacy banking system. They are, for all practical purposes, the engine that powers the modern crypto spot market.

Spot Trading vs. Crypto Derivatives

For allocators new to crypto, a common point of confusion is the distinction between the spot market and the derivatives market. Both allow trading based on a cryptocurrency's price, but they operate on fundamentally different principles.

Understanding this distinction is not just academic—it is critical. The choice of market directly impacts investment strategy, risk exposure, and whether one actually owns the underlying digital asset.

The entire difference can be summarized by one question: do you want to own the asset?

A spot trade involves the purchase of the actual asset. If an allocator buys $1,000 worth of Bitcoin on the spot market, they take ownership of that Bitcoin. It can be transferred to a private wallet, held for the long term, or used in other applications. The investor has direct ownership.

Derivatives, in contrast, are financial contracts. They derive their value from an underlying asset's price, but the trader never takes custody of the asset itself. It is more akin to speculating on the future price direction.

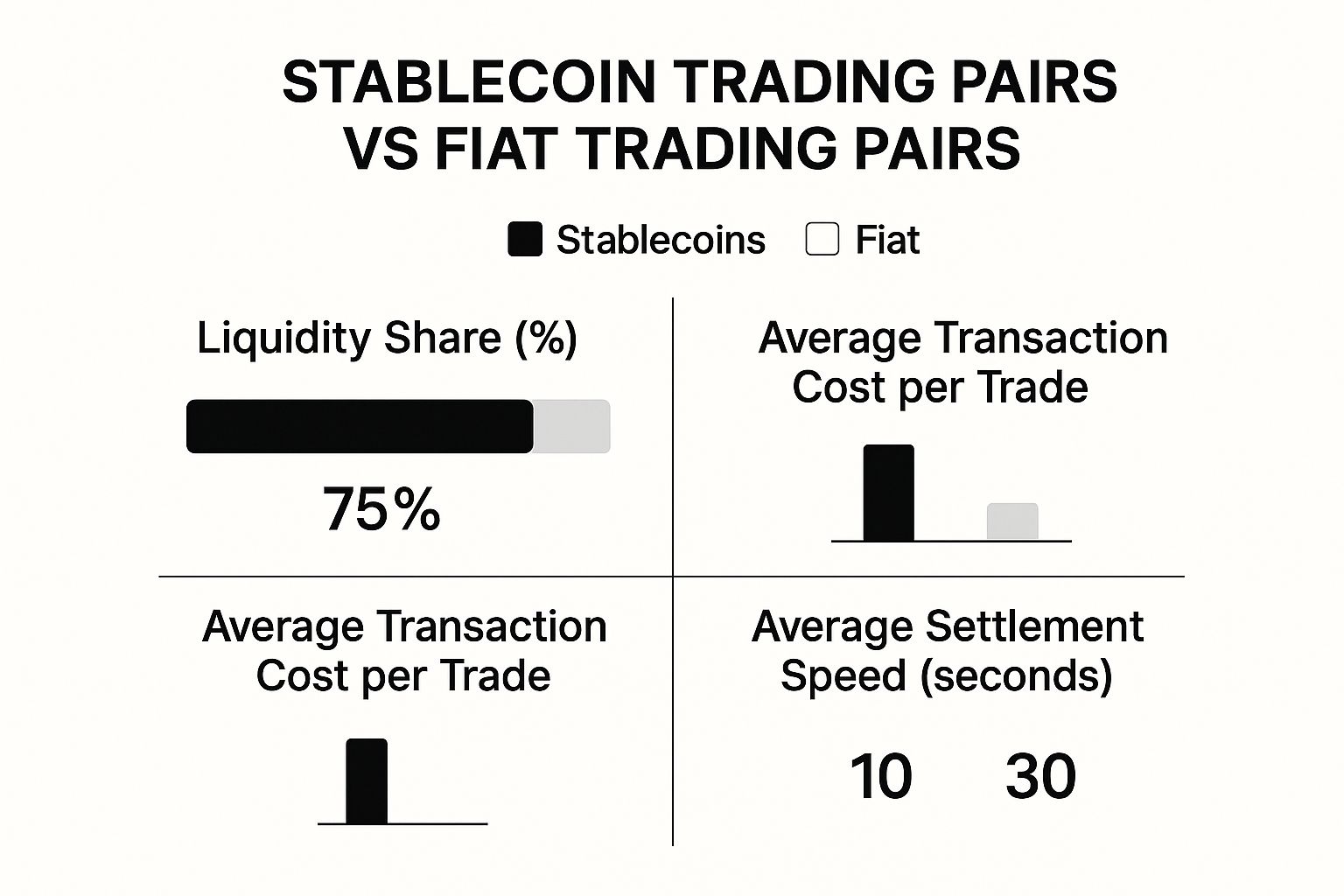

This infographic breaks down the mechanics of spot trading pairs, comparing those based on traditional fiat currency (like the US Dollar) with those based on stablecoins. You can see why stablecoins have become so dominant, offering much better liquidity and faster settlement.

The efficiency of stablecoin pairs makes them a popular foundation for both spot and derivatives trading, allowing traders to move in and out of positions quickly.

So, What Exactly Are Derivatives?

The most common crypto derivatives are futures contracts and perpetual swaps ("perps"). These are agreements to buy or sell a crypto at a predetermined price on a future date. With perpetuals, there is no expiration date.

Essentially, one is not buying Bitcoin but rather a contract that tracks Bitcoin's price. This separation from the underlying asset enables different trading strategies and introduces unique risks.

Spot trading is about direct investment and long-term ownership. Derivatives trading is primarily for speculation and hedging, often involving leverage to amplify potential returns and risks.

Because no actual crypto is exchanged, derivatives facilitate complex strategies like short-selling (betting on a price decrease) and the use of leverage, which are generally unavailable in spot markets.

Spot vs. Derivatives A Head-to-Head Comparison

A side-by-side comparison helps clarify the differences. This table outlines the most important distinctions between spot and derivatives trading.

Feature | Spot Trading | Derivatives Trading (Futures/Perpetuals) |

|---|---|---|

Ownership | Yes, you buy and own the actual cryptocurrency. | No, you only own a contract. You never take custody of the underlying asset. |

Primary Goal | Long-term investing (HODLing), direct asset accumulation. | Short-term speculation, hedging existing positions, and profiting from volatility. |

Leverage | None. You trade 1:1 with your own capital. | High leverage available (e.g., 5x, 20x, 100x), allowing you to control large positions with small capital. |

Risk Profile | Risk is tied to the asset's price falling. You only lose if you sell at a lower price. | Extremely high risk. Leverage magnifies both gains and losses. You can be liquidated and lose your entire margin. |

Flexibility | Simple buy, hold, or sell. | Can go long (bet on price increase) or short (bet on price decrease). |

Best For... | New investors, long-term believers in a project, and anyone wanting to actually use crypto. | Experienced traders with a high risk tolerance and a deep understanding of market dynamics. |

This comparison clarifies that these are two distinct financial instruments designed for different purposes.

Which One Is Right for You?

Ultimately, neither market is inherently "better"—they are built for different objectives.

Spot trading is the foundation. It is for allocators who believe in the long-term value of an asset and wish to build a genuine position over time. If you are a "HODLer," the spot market is your primary venue.

Derivatives trading is for active, short-term traders. It is a powerful (and high-risk) tool for capitalizing on market volatility or hedging a large spot portfolio against potential price declines.

For any allocator focused on building a foundational portfolio in digital assets, spot trading is the unambiguous starting point. Derivatives are a high-stakes arena best suited for seasoned traders who fully understand the associated risks.

Frequently Asked Questions About Spot Crypto

As allocators become more familiar with the basics, practical questions about the day-to-day realities of spot crypto trading naturally arise. Here are straightforward answers to some of the most common inquiries.

What Are the Main Risks of Spot Crypto Trading?

The most significant risk is price volatility. When you purchase an asset on the spot market, you own it outright, which means your investment is fully exposed to the market's often-dramatic price fluctuations.

Second is custody risk. Storing crypto on a centralized exchange means you are trusting that entity to secure your assets. This exposes you to their counterparty risk—the risk of hacks, insolvency, or operational failure. Transferring assets to a personal hardware wallet mitigates this, but shifts the responsibility for security entirely to you.

Finally, liquidity risk is a consideration, particularly with smaller, less-established "altcoins." Attempting to execute a large order for an illiquid asset can cause the price to move against you, a phenomenon known as slippage. This results in a less favorable execution price than anticipated.

Can I Use Leverage in Spot Crypto Trading?

In a standard spot trade, no. By definition, a spot trade is a 1:1 transaction where you can only trade with the capital you have available. This is a key differentiator from derivatives like futures.

However, some exchanges offer a hybrid product called margin trading on their spot markets. This allows you to borrow funds from the exchange to increase your position size, effectively applying leverage to a spot trade. It is crucial to understand that this is an advanced strategy. It dramatically magnifies both potential profits and losses and introduces the risk of liquidation.

While margin trading occurs on the spot market's infrastructure, it adds a layer of debt and risk that just isn't there in a regular spot purchase. Think of it as a totally separate product for experienced traders.

Why Choose Spot Trading Over Futures?

Most allocators choose spot trading over futures for two primary reasons: ownership and simplicity. The core appeal is acquiring the actual cryptocurrency.

Here's why that matters:

Long-Term Conviction: For investors with a long-term belief in a project (the "HODL" strategy), buying spot is the only way to accumulate and hold the actual asset.

Utility and Participation: Owning the underlying coin or token allows for its use. It can be transferred, used for payments, staked to earn yield, or used to participate in a project's governance. None of this is possible with a futures contract.

Simplicity: Spot trading is the most direct method for gaining exposure to an asset's price. There are no expiration dates, funding rates, or complex liquidation mechanics to manage, unlike with futures.

Futures are instruments designed for speculation or hedging, without ever taking custody of the underlying asset. If the investment goal is based on the fundamental value of a specific crypto, buying spot is the most logical approach.

How Are Spot Crypto Trades Taxed?

In most jurisdictions, including the United States, cryptocurrencies are treated as property for tax purposes. This is a critical detail. It means every time you sell, exchange, or dispose of a crypto asset acquired on the spot market, a taxable event is triggered, resulting in a capital gain or loss.

Maintaining meticulous records of every transaction—including the date, cost basis, and sale price—is essential for accurate tax filing. For frequent traders, this can become a significant administrative burden. Specialized software can help streamline this process. You can find a solid breakdown of the best crypto tax software to help manage these reporting requirements.

At Fensory, we provide a single, institutional-grade terminal to help allocators discover, analyze, and monitor the entire landscape of BTC and stablecoin-denominated investment products. Our platform eliminates the fragmentation of the market, offering advanced tools for due diligence and direct connectivity to fund managers. Explore institutional-grade crypto insights at https://fensory.com.